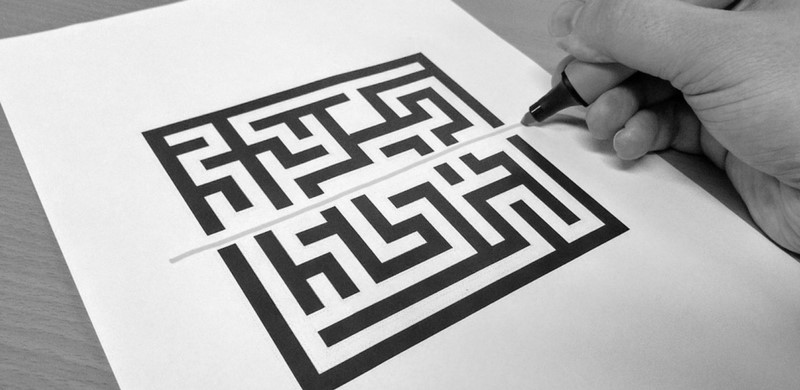

Your Share Plan – Get The First Step Right

We recently published an outline checklist for putting in place an employee share plan. Step one on that checklist is producing a blueprint for the design of the employee share plan. This is important not just to get the design of the employee share plan right...