How big should share awards be – what is too large / too small?

When we begin to speak with clients about employee share plans, one of the questions we are consistently asked is, “what size should the award be”?

This is, of course, an extremely important question, but unfortunately not one which is necessarily very simple to answer.

There are numerous influencing factors, though if I had to pick the 3 most common, I would suggest:

1. Dilution for existing shareholders – what will they be willing to accept?

This plays an extremely important role in the decision-making process, particularly where there are multiple shareholders involved.

Whilst it is essential to get the award level right to incentivise employees, it’s also vital not to create disincentives for existing shareholders – not least because shareholder consent will often be required to introduce a plan!

It is particularly important where shareholdings are close to various different ‘threshold’ levels. For example, where the majority shareholder is teetering close to the 50% mark, any dilution below 50% is likely to be a contentious issue. Equally, minority shareholders who may otherwise benefit from Entrepreneurs’ Relief (and an effective Capital Gains Tax rate of 10%), will risk losing this benefit should their shareholding fall below 5% – increasing the Capital Gains Tax liability to 20% (in the case of higher rate taxpayers).

Designing a share plan that only ‘crystallises’ on an exit event, such as an Enterprise Management Incentive (EMI) share option, is a relatively simple way of addressing some dilution worries.

Where a more detailed analysis of the potential long-term effects is required, we always recommend conducting equity modelling exercises to gain a thorough understanding of how dilution could impact existing shareholders.

2. Expectations of employees

Another big influencer will relate to the expectations of your employees. Perhaps, when you floated the idea of share incentives with employees, your top salesperson came back and suggested they should receive 10-15% equity. Perhaps, due to their performance, that even sounded like a reasonable request.

As a rule of thumb, we would usually suggest using a notional total share pool of around 10% for employee awards. This may not be appropriate in every situation, but certainly acts as a good starting point. In addition, it is typically an amount that potential investors are comfortable with.

For senior employees, you may wish to consider around 3-5% for an individual award (again, as a starting point), and for more junior level employees a suitable level may be in the region of 0.5% – 1%. With senior employees, there will likely be a certain degree of negotiation, so it is important to understand the limits you are willing to stretch to when reaching a decision.

Finally, remember that share rewards can always be increased – for incentive purposes, it is beneficial to spread awards over the longer term, linked to the achievement of performance/growth/retention targets, instead of providing larger awards up front.

3. Long-term gains

This point plays a crucial role in both of those mentioned above. It is one of the most important things to consider, and often something which can be overlooked in the early stages of planning.

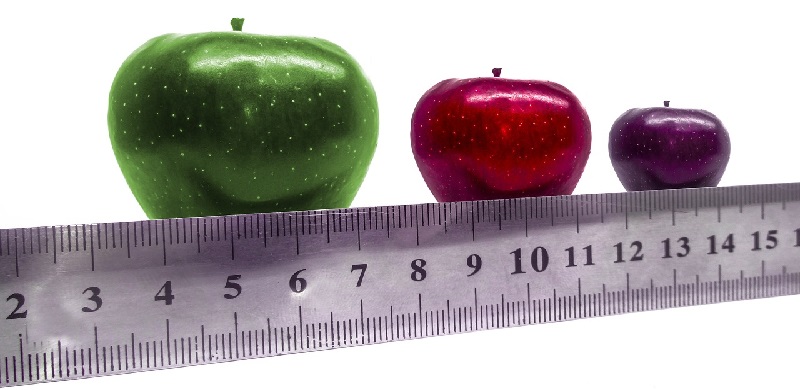

On the surface, and especially for SMEs and private companies where the ultimate value is uncertain, an award of, say, 5% may not seem like very much. However, when one considers the potential financial uplift that can be realised if the company achieves or even surpasses its growth projections, 5% can start to look very appealing.

Wouldn’t you rather have 5% of £5 million, than 15% of £1 million?

This is another area where equity modelling can provide much needed insight into the gain that can be achieved if growth targets are met. It can also help you reach a decision on realistic performance targets, designed to drive employees towards achieving that growth. Communicating this potential to employees is absolutely key for an effective share plan.

So, what size should my share reward be?

At the end of the day, there are no right or wrong answers to this question. Every company and participant is different, and this means that a one-size-fits-all approach is rarely ever going to provide the optimised solution.

At RM2 we are experienced in understanding the long-term objectives of our clients, and can provide expert guidance on an appropriate size of share reward to help achieve your goals.Give us a call on 0208 949 5522 or email enquiries@rm2.co.uk to see how we can help you.