RM2 acts for architecture firm’s move to EOT

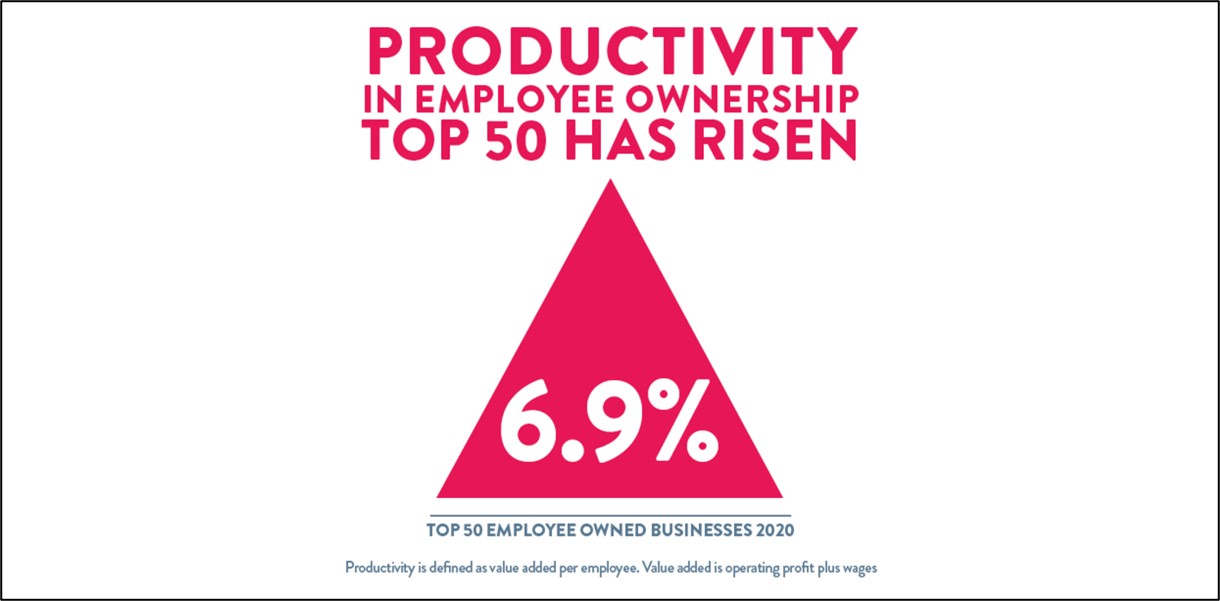

rhp is now an EOT! rhp is pleased to announce that we have become an Employee Ownership Trust (EOT), meaning that we are now wholly owned by all our employees. A strong collaborative culture has always been a key aspect of the way we run our...